It’s not the ‘quantity’ of capital, but ‘quality’ of its management that decides the financial-fate of a brand! 💯

Introduction

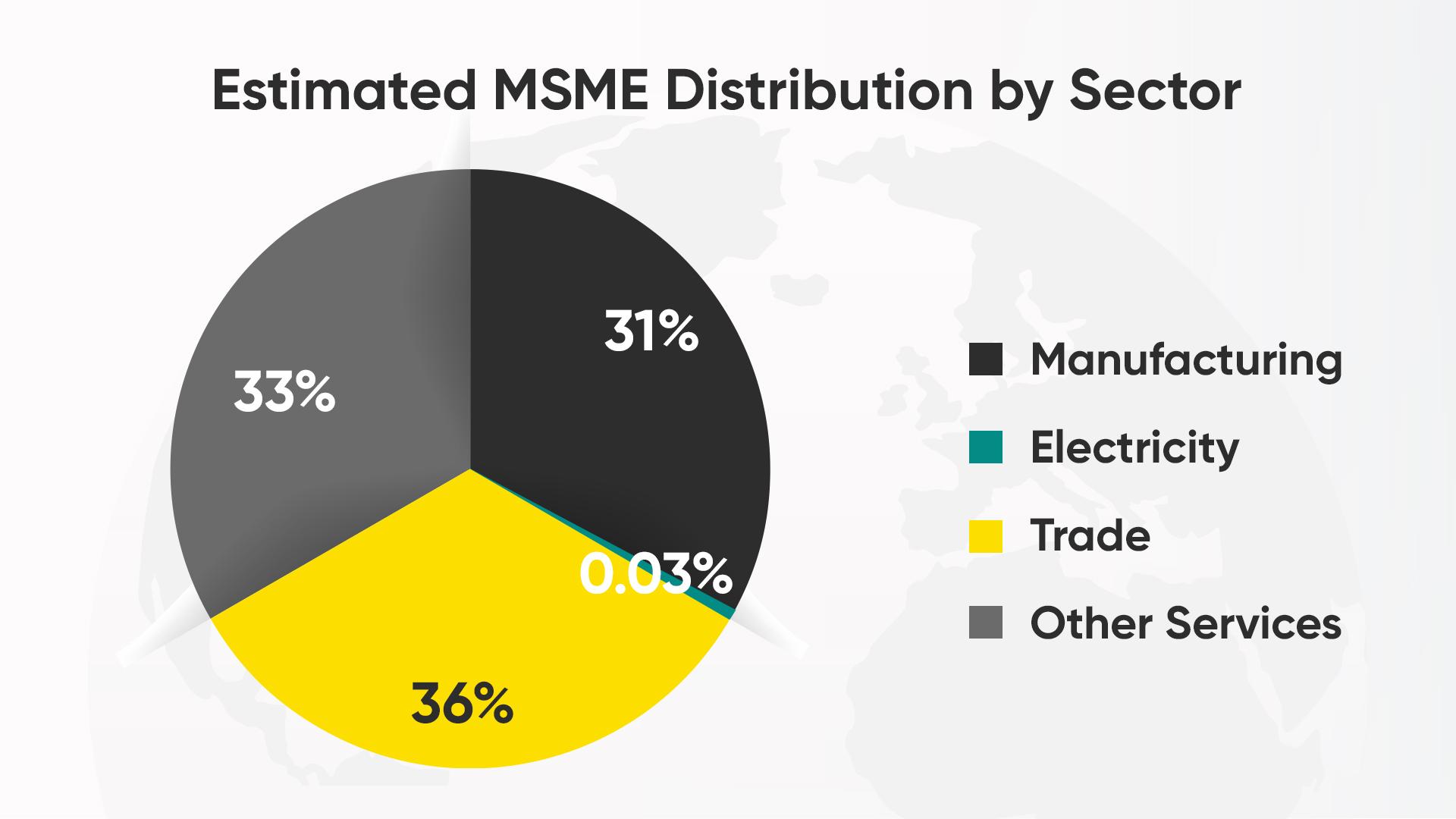

In India, the Micro, Small and Medium Enterprises (MSME) sector is second only to Agricultural. Though new on the economic radar, this sector promises a lot. Its current vibrance and vivacity impacts the nation on various fronts like:

- GDP

- Economic output

- Employment

- Social development

- Sustainable development

- Innovation

- Decentralization

These units that pump a humongous amount of value into the country’s economy need to be secured and backed-up with strong financial planning.

Though the relevance of managing finances is undisputed, while catering to other pressing aspects of business it is easy to lose track of the financial stand-point. 💲

Financial planning is incomplete without budgeting and forecasting, together they complete the coin. If budgeting is the imprint on a coin that generates value, then forecasting is like the sheen adding glimmer.

This blog aims at discussing on how MSMEs can focus on financial budgeting and forecasting.

Importance of Budgeting and Forecasting for MSMEs

In an MSME’s life-cycle finance is a vital ingredient at various stages like:

- Start-up stage

- Survival stage

- Growth stage

- Sustenance stage

Budgeting is like designing a goal-sheet for a company with specific agendas. And forecasting is like putting a date on those goals. 🎯

Budgeting and forecasting establish the company up on the path of progress a year at a time. It integrates contradictory traits like hope and dreaming big alongside of conservativeness and being-grounded.

Best Practices for Budgeting

Financial budget is a statement of expected revenue and expenses in a given financial tenure (usually a year). It’s an opportunity for the company’s leadership to set the pace for an up-coming year. They delve into the ground-reality and devise tactical action-plans to get there. Budgeting sets the pace for:

- Staffing

- Production

- Inventory

- Borrowing

- Revenue management

Three major aspects of budgeting that suffice to identify the best budgets from the rest are: areas of budget allocation, possible methodologies and the strategies to get there.

Areas of budget allocation:

- Financial

- Production

- Sales

- Marketing

- Capital

- Cash management

- Project based

Methods of budgeting:

- Growth budgeting:

Growth is every company’s dream. With growth in income a brand experiences increment in expenses too. Ex: if the leadership is looking at a 9% income-growth during an upcoming tenure, they must allocate a 9% increased budget for the expenses too.

- Value-based budgeting:

Across various aspects of each business, value generated from each one of them can differ. In this type of budgeting the leadership can identify the most value-generative aspect of their business and allot an increased budget for it. Ex: If some company finds value in R&D it should invest more into it.

- Activity-based budgeting:

In this type, historical data and analysis plays a crucial role. Once the company can pin-point the activities like marketing, or feedback collection etc. that might have worked well for their growth in the past, then, can root-in on it again.

- Make-over budgeting:

While wardrobe and styling makeovers are common, budgeting make-over is uncommon but ain’t unheard of. In this the leadership assumes new-eyes and views the brand / company in fresh light. This perspective is more helpful in curbing negative-budgeting outcomes of the past.

Strategies of budgeting:

- Involving stakeholders: to increase the sense of belongingness.

- Accessing historical data: to ensure company dodges the revival of old ghosts.

- Analyzing the past performances: to enhance the further ones with well sketched out dos and don’ts.

- Considering industry benchmarks: to identify where the glass ceiling is assumed to be.

- Realistic and simplistic approach: to ensure the progress remains swift and constant.

- Timely reviewing and revising: market dynamism prompts the inclusion of this aspect to meet the yearly goals.

Best Practices for Forecasting

Financial forecasting can safely be termed as a pre-requisite for budgeting. It helps draw a clear picture of many aspects expected to impact a business. Forecasting employs historical data and statistical analysis to attain its targets. 📊

Financial forecasting paves the way for an efficient budget allocation and devising a strategic roadmap for the company. Forecast works well for both short / long-term.

Effective financial forecasting materializes by engaging in three significant factors:

Quantitative factors:

- Trust historic data

- Identify and analyze key trends

- Prepare multiple forecast version

- Trust numbers, not assumptions

Qualitative factors:

- Begin with the end in mind

- Be conservative yet visionary

- Reflect upon unforeseen scenarios handled in the past

- A successful forecast would deviate within or around 4% only

Reflective factors:

- Incorporate feedback from stakeholders

- Regularly review and adjust the forecast

- Dynamism along the journey will bag more fruits

- Utilize top-down and bottom-up both the approaches for better outcomes

Tools and Technologies for Budgeting and Forecasting

This task surely ain’t a cake-walk, instead it’s a roller-coaster ride. 🎢 Various tools and techniques can be employed to ease the task. While record keeping is a common tool in every aspect, other aspects can be divided into two major categories like:

IT aspect:

- Excel spreadsheet

- It’s a handy and easy option when the needs are less than intense.

- Advanced Software

- Some examples of this are; Finly, Peakflo, Anaplan, Vena, Casual, Planful, Board, Onestream etc.

- Online services

- Many software and application companies provide digital portals and all in one processing platforms too.

- Apps

- Some known apps that do this well are, Empower, YNAB, Mint, PocketGuard, Goodbudget, Stash, Honeydew, Digit etc.

- Advanced Software

Human aspect:

- Reliable vendors

- Improved deadline commitments

- Quality check

- Regular learning & trainings

Like every coin, budgeting and forecasting also comes with its own drawbacks. Although these activities sound like a one-time task to be done every year; it is anything but that! Dynamism is an integral ingredient here. When a company / brand falls short on dynamism and improvisation it’s like as good as planned to fail.

🏳️🔴 The red flags of financial budgeting and forecasting can be:

- Unrealistic targets

- Micromanaging the finances

- Overlooking of other business-aspects

- Falling into the rigidity trap

- Inviting internal conflict and blame-game

- Risk of losing out on the long-term agendas.

🏳️🟢 Here the green flags are worth a look too:

- Goal clarity

- Measurable targets

- Accurate revenue handling

- Enhanced accountability

- Promotes coordination

- Improvised inter-department communication

- High on confidence and motivation

- Satisfaction of being in control

In spite of their contribution, MSMEs in India face several challenges like high cost of credit, rapidly changing technologies, competitive market etc to name a few. In the wake of the insecurities, building finer practices around the financial fore-front remains vital. 📝

Market uncertainty is a reality that cannot be escaped but can be survived. Appropriate financial forecasting and budgeting does exactly that.

When MSMEs embrace data and analytics in combination of right tools with proper budgeting and forecasting they leverage a strategic advantage of having prepared. Rewards of saving on crucial time, reducing errors, clarity, disciplined management etc. are ensured. More the accuracy they target, exponential are the benefits. 🧮

To understand how Stratefix can empower your business in its journey of financial budgeting and forecasting click here.